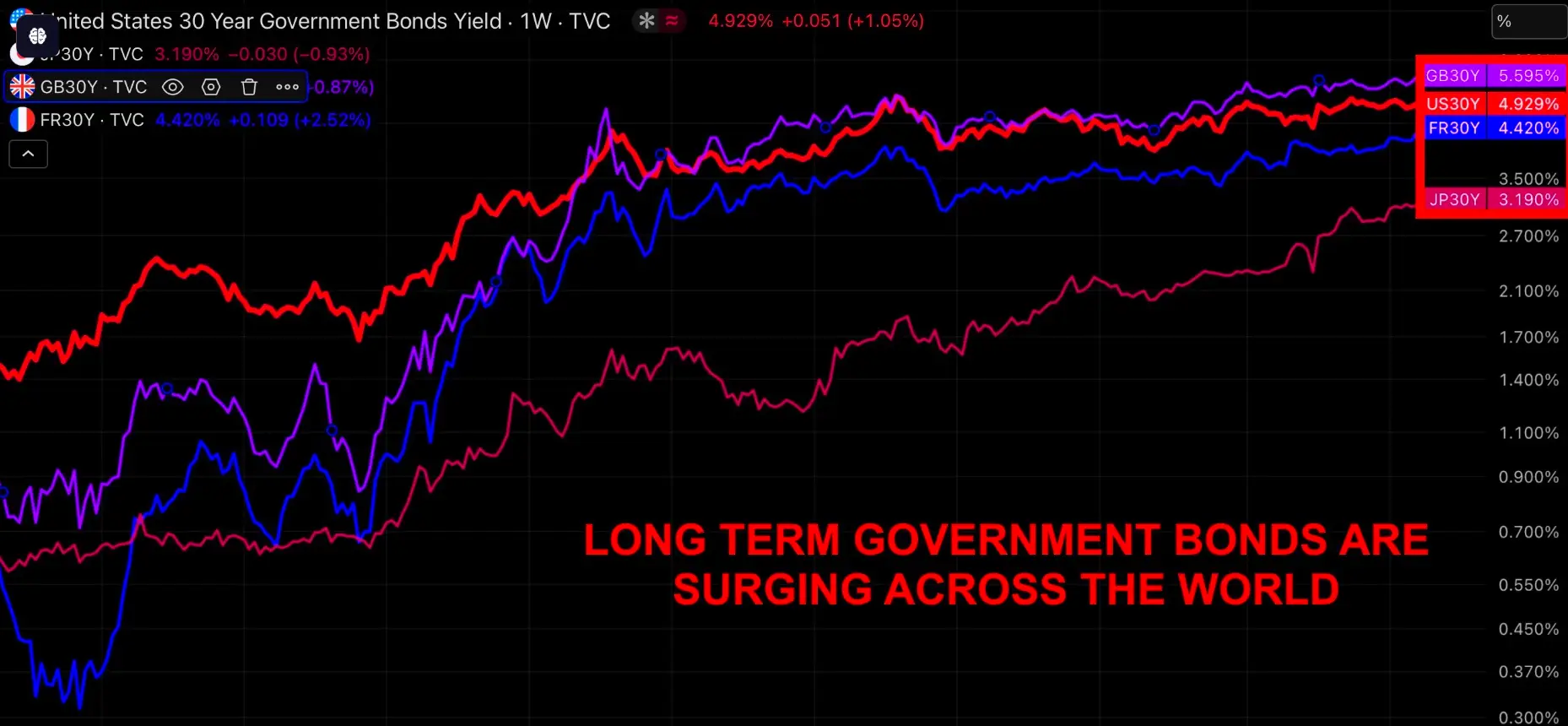

The global bond market is undergoing a profound transformation. From the US to Japan, France to the UK, even as central banks pause or begin cutting interest rates, long-term government bond yields continue to climb to multi-decade highs.

The drivers behind this dramatic correction in global bond markets are clear: surging fiscal deficits and rising public debt, stubbornly high inflation, questioning the credibility of central banks, shifting investor sentiment, and the return of bond "vigilantes."

The market is pricing in a new normal of increasing fiscal pressure and generally higher borrowing costs. A 5% long-term bond yield may become the new benchmark for global finance.

Wider fiscal deficits are pushing up yields.

The extent to which spending exceeds tax revenue in European and American countries is steadily increasing.

The situation in the US is particularly striking, with its debt-to-GDP ratio climbing from less than 80% before the pandemic to a projected nearly 120% by mid-2025. Even in good economic times, the US fiscal deficit remains around 6-7% of GDP, an anomaly that has put upward pressure on Treasury yields.

To bridge the gap, the US government is forced to issue more bonds. When the market is oversupplied with bonds, investors demand higher yields to buy.

The UK faces a similar dilemma, with borrowing demand expected to reach a record high in early 2025. Long-term UK government bond yields have climbed above 5.6%, the highest level since 1998, reminiscent of the market's sharp reaction to unfunded spending plans during the 2022 "mini-budget crisis."

Japan has the heaviest debt burden, exceeding 250% of GDP. For years, the Bank of Japan has used yield curve control to limit yield increases, but global pressure has forced it to adjust its policy, causing the 30-year Japanese government bond yield to exceed 3% for the first time.

Persistent Inflation and the Test of Central Bank Credibility

Analysts at StockMarket.News believe that inflation is another global driver.

When prices rise broadly across the economy, the real value paid by fixed-income bonds erodes. If inflation continues to rise, investors won't accept low yields; they'll demand higher returns to protect their capital.

Typically, slowing economic growth pushes yields down. But this time, investors face two risks: recession risk on the one hand, and stubborn inflation compounded by fiscal pressures on the other.

Currently, inflation and debt risks dominate.

Central bank policy adds another layer of complexity. After aggressive rate hikes through 2022-23, central banks have paused. The Federal Reserve maintains rates at 4.25-4.50%, while the European Central Bank and the Bank of England have begun cutting rates.

Yet, bond yields continue to rise, largely due to quantitative tightening (QT).

For years, central banks have pushed down yields by purchasing bonds (quantitative easing). Now, they are shrinking their balance sheets, reducing their role as bond buyers. When investors must absorb more supply, they demand higher yields to act.

The Return of Bond Vigilantes and Global Spillover Effects

Investor psychology has shifted fundamentally. In the 2010s, investors generally assumed that "low yields would last forever." With debt and inflation resurfacing,

But that era is over. Bond vigilantes have re-emerged—investors who force governments to exercise fiscal discipline by selling bonds.

This behavior has been evident in multiple markets: US long-term Treasury auctions are facing difficulties, UK 30-year bond sales are experiencing weak demand, the yield gap between French and German government bonds has widened, and Japan's 30-year bond auctions underperformed in 2025.

Safety flight has also weakened. Past crises, wars, or shocks typically triggered a rush for bonds. But in 2023-24, even amid ongoing global conflict, bond yields barely fell. Investors are now more focused on inflation and debt than on a pursuit of safety at any cost.

Research by the Bank for International Settlements found that one-third of the movement in European yields can be directly traced to US Treasury bonds. When US yields rise, France, Germany, the UK, and Japan follow. The US sets the tone, but all countries pay the price.

A structural reset in global bond markets

This isn't just a problem for individual countries; it's a global phenomenon. Long-term yields are rising collectively, ending the era of ultra-low interest rates. From Washington to Paris to Tokyo, borrowing costs are rising again.

Credit ratings are further highlighting the disparity between countries. The United States lost its AAA rating from Fitch in 2023, while the UK and Japan have already seen their ratings fall. France retains its AA rating, but the ratings agency has warned of rising debt.

Germany and Canada have retained their AAA ratings, but even they are facing rising yields. Investors are demanding higher returns across the board.

For governments, investors, and the broader economy, this means governments will face ballooning interest payments, investors will demand higher loan rates, and fiscal pressures are spreading across economies. Unlike in the 2010s, central banks cannot simply intervene with cheap money to solve the problem.

Global bond markets are undergoing a repricing, not an aberration but a structural reset. A 5% long-term bond yield may become the new normal in global finance.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)