Recently, the New York Times revealed an executive order being drafted by the Trump administration.

The content primarily addresses three key areas:

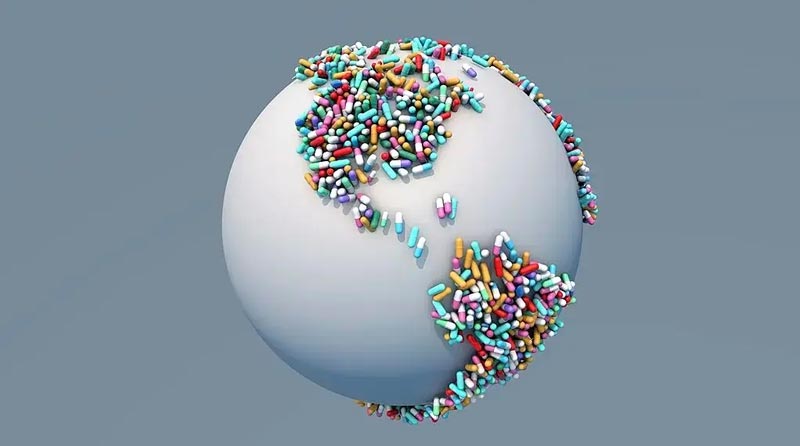

- Bringing antibiotic manufacturing back to the US;

- Adding an additional safety review to BD transactions between Chinese and US pharmaceutical companies;

- Stricter requirements and higher fees for clinical trials in China.

Following this news, several pharmaceutical stocks fell. As of the close of trading on September 11th, BeiGene's Hong Kong shares fell 6.9%, Hengrui Medicine's Hong Kong shares fell 3.03%, and Akeso Biopharma's fell 4.3%.

Some investors believe this round of BD-driven pharmaceutical bull market may be over. However, most industry insiders believe this draft is unlikely to be implemented, as it not only lacks reliable efficacy guarantees but also faces opposition from powerful multinational pharmaceutical companies.

It is worth noting that this rumor itself illustrates a key point: the rise of innovative Chinese drugs poses a threat to the US, leading to concerns that Shanghai will replace Boston as the hub of biopharmaceuticals.

01. Innovative Drug BD Transactions Targeted

The most noteworthy aspect of the draft is the restrictive clauses targeting innovative drug BD by Chinese and American companies.

Currently, BD transactions for innovative drugs have replaced market financing, providing a continuous source of revenue for the development of innovative drugs in China. According to data from Pharmaceutical Cube, the total value of pharmaceutical-related transactions in China reached US$60.8 billion in the first half of this year, US$3.7 billion higher than the total value for all of 2024, a year-on-year increase of 129%. Of this, down payments from license-outs alone have surpassed the total amount of financing in the primary market.

The largest buyers of these massive BD transactions are American companies.

Analysis shows that over the past decade, 204 license-out transactions in China involved American companies, accounting for 49% of the total number of transactions and a whopping 55% of the total transaction value. If not for the rise of innovative Chinese pharmaceutical companies, the majority of this capital would likely have flowed to American biotech companies.

More than a decade ago, the US biopharmaceutical industry established a clear division of labor from financing to exit: VCs placed early-stage bets, biotechs focused on drug development, exited through secondary market IPOs or acquisitions by major pharmaceutical companies, and then reinvested the resulting funds in a new round of early-stage projects.

This capital cycle is crucial to the functioning of the US innovation ecosystem and is the fundamental reason why the US has become a global biopharmaceutical powerhouse over the past few decades.

However, currently, both financing and exits for innovative US pharmaceutical companies are facing severe competition from Chinese companies. In the first half of 2025, North American biopharmaceutical investment and financing secured only $11.2 billion in venture capital, a 35.6% year-on-year decrease. The IPO window for innovative pharmaceutical companies has also closed.

In previous years, at least 12 US biotech companies would go public annually. However, in the first half of this year, Renaissance Capital data showed that the number of US biotech IPOs fell to its lowest level since 2012, with only a handful of innovative pharmaceutical companies successfully IPOing.

Millennial pharmaceutical companies are turning to China for innovative drugs, as China's pipelines are much more affordable. Data from DealForma shows that in the first half of this year, 38% of large-scale drug development (BD) transactions by multinational pharmaceutical companies involved Chinese drugs, compared to almost zero a decade ago.

Exit channels for US biotech have been almost completely blocked, and the capital market has shifted from enthusiasm to apathy. In the first half of the year, the XBI Index, a proxy for US biotech performance, fell 7.9%, in stark contrast to the doubling of the Hong Kong Innovative Drug Index.

This has undoubtedly affected the interests of certain US interest groups.

For example, many of the financial institutions who have been whispering to Trump hold shares in US emerging companies, but these companies' performance and stock prices are underperforming, putting their assets at risk. Consequently, they have begun to advocate for US restrictions on BD transactions between Chinese and US pharmaceutical companies.

02. The feasibility of sanctions is questionable

This US attack on Chinese innovation may appear aggressive, but it is unlikely to be implemented.

According to the core content of the disclosed draft, US pharmaceutical companies seeking to acquire drugs or technology from Chinese companies will face stricter scrutiny from the Committee on Foreign Investment in the United States (CFIUS). CFIUS is designed to review foreign acquisitions of sensitive U.S. assets for potential national security risks.

Now, American politicians are proposing to use it to restrict U.S. pharmaceutical companies from purchasing innovative Chinese drugs and technologies. This is tantamount to preventing domestic companies from enhancing their competitiveness, a self-defense measure that is clearly irrational.

Well-known pharmaceutical companies, such as Pfizer, AstraZeneca, and Merck, do not support increased scrutiny of Chinese innovative drug BDs.

Previously, Pfizer's CEO publicly stated in an interview that policies that hinder China should not be adopted, as this would also affect cancer treatment for American patients.

The major pharmaceutical companies' stance is understandable. The R&D costs of innovative Chinese drugs are significantly lower than those in the United States. By introducing high-quality, affordable Chinese innovative drugs through BDs, multinational pharmaceutical companies can easily mitigate the patent cliffs facing several future blockbuster drugs.

From a profit distribution perspective, multinational pharmaceutical companies also stand to gain. Sales revenue generated by Chinese pharmaceutical companies through BDs accounts for only one-third of their profits, while multinational pharmaceutical companies receive approximately two-thirds, making them the primary beneficiaries of BD pipelines. Therefore, restricting BDs can be seen as a self-defeating strategy.

Multinational pharmaceutical companies, like financial institutions, must take the US government's opinions seriously. After all, they have deep pockets and powerful lobbying power in Congress, having successfully blocked the enactment of policies that would have adversely impacted them in the past.

With such strong opposition from interest groups, this draft bill, lacking a clear implementation path, is likely to die. In a statement, the White House also stated that it was not actively considering it.

In fact, the Trump administration's sanctions on Chinese innovative drugs have been all talk and no action. Previously, the biosafety bill targeting the CXO sector, which had been called for for years, has yet to be implemented, let alone the broader scope of innovative drug BD transactions.

Overall, this US crackdown on Chinese innovative drugs is more of a political gesture than a viable policy. It may cause some short-term fluctuations, but in the long term, it will not significantly impact the overseas expansion of Chinese innovative drugs.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)