Wall Street's most powerful tech Mag Seven is looking a bit dated. Make way for the "Great Eight," or the "Golden Dozen," or even the "TenAI of GenAI."

It's been nearly three years since OpenAI's ChatGPT propelled artificial intelligence to the center stage of the global economy, fueling a single trading theme dominating the US stock market: buy the tech Mag Seven. Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla—these seven stocks are seen as the best bets to deliver outsized returns to investors during the biggest technological shift since the internet era.

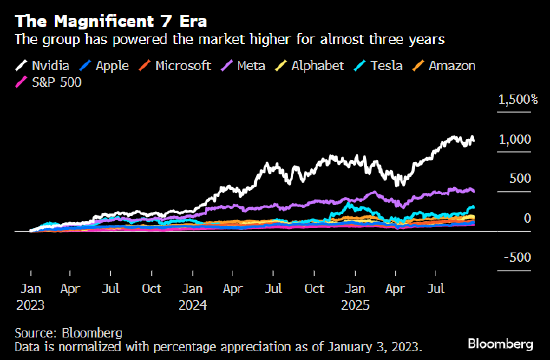

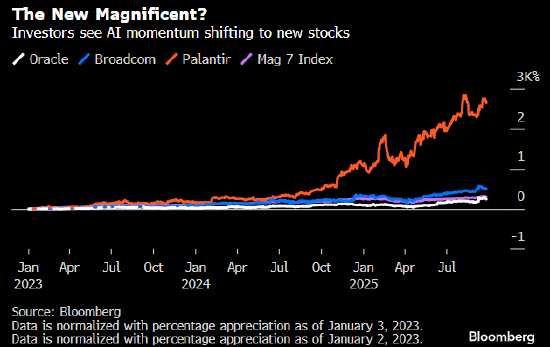

While this has largely materialized, an interesting thing has happened on the road to global dominance. AI trading has expanded in unexpected ways, even beyond the market's favored large tech companies. The "Tech Mag Seven" has accounted for more than half of the S&P 500's more than 70% gain since the beginning of 2023, but an investment strategy based on this group has also left investors missing out on companies poised to thrive in an AI-driven future, such as Broadcom, Oracle, and Palantir.

"Just because the Mag Seven won in technology cycles like mobile, internet, and e-commerce doesn't mean they will win here," said Chris Smith, portfolio manager at Antero Peak Group, a subsidiary of Artisan Partners. "The next wave of winners will be those that use AI to address large, unconstrained markets, and they will become even larger than the current Mag Seven."

That's not to say the original Mag Seven is dead. They comprise almost 35% of the S&P 500's weighting, and their earnings are expected to grow by more than 15% by 2026, with revenue growth expected to be 13%. The rest of the S&P 500, excluding the Mag Seven, is projected to see a 13% profit increase and 5.5% revenue growth next year.

However, stock price performance among the Mag Seven members has diverged. Nvidia, Alphabet, Meta, and Microsoft are considered well-positioned in AI, with their stock prices rising between 21% and 33% this year. Meanwhile, the prospects for Apple, Amazon, and Tesla are less clear, and their stock prices have significantly lagged.

"It's hard to see the current Mag Seven as the best representation of the AI sector," said Smith.

As a result, Wall Street has been making various adjustments to the theme to capture the true winners. Some have streamlined it to the Big Four: Nvidia, Microsoft, Meta, and Amazon. Jonathan Golub, chief equity strategist at Seaport Research, has suggested removing Tesla and creating a "Big Six" label. Others, like Ben Reitzes, an analyst at Melius Research, prefer to add chipmaker Broadcom to the Mag Seven, creating the "Great Eight." Broadcom is currently the seventh-largest company in the United States by market capitalization.

But none of these figures capture the entire AI industry. For example, Oracle's stock price has risen over 75% this year as its AI-related cloud computing business booms. Palantir is the best-performing stock on the Nasdaq 100 so far, having surged 135% since 2025, driven by strong demand for its AI software.

"A company can become too big to ignore," said Jurrien Timmer, head of global macro at Fidelity Investments, which manages $16.4 trillion in assets. "As AI advances, new winners can replace old ones even if previous winners continue to perform well."

The concept of the "Mag Seven" is not new on Wall Street. They like to create a series of popular stock labels to make it easier for investors to understand the market, from the "Nifty Fifty" in the 1960s, to the Nasdaq "Four Horsemen" in the dot-com era, to the "FAANG" stocks that dominated the smartphone and AI era in the early 2000s. However, these giants, once dominant, are eventually replaced by newer companies, a seemingly inevitable trend in the field of artificial intelligence.

In a sign that Wall Street is looking beyond the "Mag Seven," Cboe Global Markets Inc. The launch of futures and options based on the CBOE Magnificent 10 Index, which includes the original Mag Seven as well as Broadcom, Palantir, and Advanced Micro Devices Inc.

The index illustrates the subjective nature of this practice. CBOE announced the news on September 10th, as Oracle posted its biggest single-day gain since 1992, solidifying its position as a major AI winner with its strong forecast. Oracle's stock price has outperformed most of the Mag Seven since the beginning of 2023, but it still hasn't made the CBOE Magnificent 10.

"We really need to expand the discussion beyond the Mag Seven," said Nick Schommer, a portfolio manager who oversees approximately $34.7 billion in investment strategies. "Oracle is definitely part of it now, as is Broadcom."

The CBOE declined to comment on the index's methodology, but in a press release announcing the Magnificent 10, it said that member stocks were selected "based on liquidity, market value, trading volume, and leadership in areas like AI and digital transformation."

Next Generation Leaders

Wall Street experts have listed numerous potential next-generation leaders, with a few companies being mentioned particularly frequently. Like Oracle and Broadcom, TSMC is considered a crucial component of the AI ecosystem. Furthermore, Palantir is considered one of the few winners in AI software, leaving former leaders like Salesforce and Adobe feeling left behind.

As for which stocks are no longer as strong, Apple and Tesla are most frequently mentioned. Apple hasn't generated the same level of growth as other tech giants, and it's considered a significant lag in AI. Meanwhile, Tesla's electric vehicle business is under pressure due to declining sales and intensifying competition.

But both companies still have a large following in the stock market, betting they will join the trend when the time is right. For Apple, the key is that the iPhone will become the platform for mass consumer adoption of AI. Tesla investors hope that CEO Musk will drive future growth by promoting autonomous driving and humanoid robotics, both of which require AI.

The list of industries poised to benefit from AI is also growing, including power companies and other sectors building AI infrastructure, such as communications equipment company Arista Networks Inc., memory chip maker Micron Technology, and storage companies Western Digital, Seagate Technology, and SanDisk.

Another challenge in targeting the AI industry is that several key companies remain private. OpenAI might appear on any list of AI winners, but for most investors, it's out of reach. OpenAI is reportedly in preliminary talks for secondary stock sales by current and former employees, potentially valuing the company at approximately $500 billion. Anthropic and SpaceX are also unlisted.

As AI becomes more widespread, the beneficiaries are likely to shift from companies that facilitate its rise to those that provide AI-specific services and products, and ultimately, to businesses that leverage AI to improve efficiency and growth. This shift could determine the ultimate winners in AI, regardless of the designation Wall Street ultimately assigns them.

“As this evolution occurs, the leaders in the AI boom may become expensive, their growth and cash flows may no longer look as good, and deals will start to fray at the margins,” said Fidelity’s Timmer. “The problem with market concentration is that as the hype around the leaders fades, we could face disruptive change.”

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)