Still-high funding pressures in U.S. money markets, coupled with a gradual decline in the amount of bank reserves held by the Federal Reserve, suggest the central bank may be nearing the end of its balance sheet reduction.

Since early September, the overnight funding market, where banks and asset managers conduct day-to-day lending, has been volatile. Ultra-short-term interest rates, which have steadily risen as the Treasury replenishes its cash reserves, remain stubbornly high.

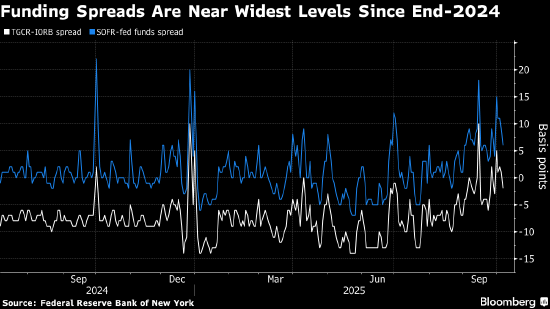

As a result, the spread between the Secured Overnight Financing Rate (SOFR) and the Fed's benchmark interest rate—the effective federal funds rate—is nearing its widest level since late 2024. Meanwhile, the latest data shows that bank reserves have fallen to just below $3 trillion, the lowest level since January.

Federal Reserve Chairman Jerome Powell said last month that bank reserve balances remain "ample" and have not yet reached the minimum level needed to buffer market volatility, but he acknowledged that they are getting closer. Federal Reserve Governor Christopher Waller previously estimated this "ample" level at around $2.7 trillion.

With market indicators pointing to tightening funding costs, market observers believe bank reserve balances are rapidly approaching this level.

"While this move is not unexpected, it suggests that reserves are approaching 'ample' rather than 'ample,'" John Velis, FX and macro strategist at Bank of New York Mellon, wrote in a note to clients on Tuesday (October 7). "The challenge for the Fed now is to assess where the shift in the liquidity demand curve will occur."

Since 2022, Federal Reserve officials have been shrinking the central bank's balance sheet—a process known as quantitative tightening. Earlier this year, the Fed slowed the pace of reductions, reducing the number of bonds that mature each month and are not rolled over.

The Federal Open Market Committee will release the minutes of its September 16-17 meeting on Wednesday (October 8), which are expected to reveal the central bank's latest stance on this issue.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)