The Federal Reserve is expected to cut interest rates for the second consecutive time this week to support a volatile job market. However, with inflation remaining a concern, any move to extend the easing cycle beyond October is likely to face renewed opposition from some officials.

While dovish Fed members currently hold the upper hand in the debate and have pushed for rate cuts, policymakers on the opposing side worry about cutting too far.

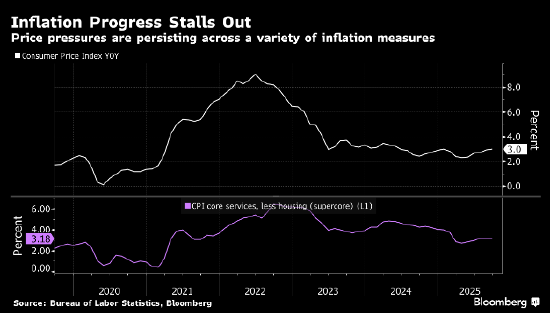

The latest consumer price index, released last Friday, showed core inflation at its lowest level in three months in September. While this further supports the Fed's plans to cut interest rates this week, the overall slowdown in prices is insufficient to justify further rate cuts.

"This leaves the Fed with an accommodative bias in October," said Nicole Cervi, an economist at Wells Fargo. "But the fundamentals for inflation haven't changed materially."

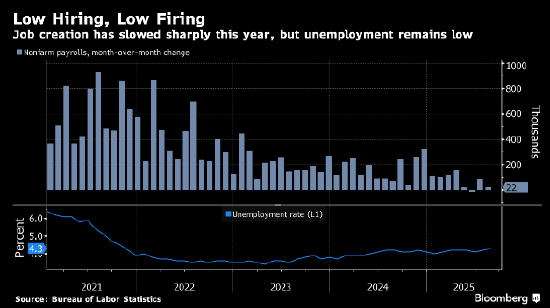

This year, policymakers have remained on hold, awaiting assessments of the impact of tariffs and other policy changes on the economy. After a sharp slowdown in summer hiring, officials decided in September to cut the benchmark interest rate by 25 basis points. They also projected two more rate cuts by the end of the year.

Since that meeting, the latest labor market data—private sector data that fills in some gaps left by the government shutdown—has offered little encouragement. Earlier this month, Fed Chairman Jerome Powell said the labor market has "actually softened substantially" and noted that "there are considerable downside risks."

As a result, futures markets are almost fully pricing in a 25 basis point rate cut this week, another in December, and another in March.

Investors in the $29 trillion U.S. Treasury market have reaped rich rewards this year, fueled by expectations of Fed rate cuts, putting it on track for its best annual performance since 2020. Expectations of further rate cuts have extended the rally this month, with a 1.1% gain.

"It will be very difficult to escape the 50 basis point rate cuts currently priced into the next two meetings," said Vishal Khanduja, head of the broad market fixed income team at Morgan Stanley Investment Management. "It's difficult to justify a deviation from market expectations."

Friday's CPI report (October 24) did not dampen trader enthusiasm. The 10-year Treasury yield fell below 4%, approaching levels not seen since April.

"This is a very aggressive strategy being taken by financial markets, and there hasn't been any explicit opposition from Fed leadership," said Stephen Stanley, chief U.S. economist at Santander US Capital Markets.

However, some regional Fed presidents, including Alberto Musalem of St. Louis, Jeff Schmid of Kansas City, and Beth Hammack of Cleveland, may object. Interest rate projections released in September showed that nine of the Fed's 19 policymakers favored at most one more rate cut this year, with seven favoring no further cuts.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)