Forecasters expect U.S. President Donald Trump’s trade war to hit growth this year and next as tariffs push up prices and curb consumer spending.

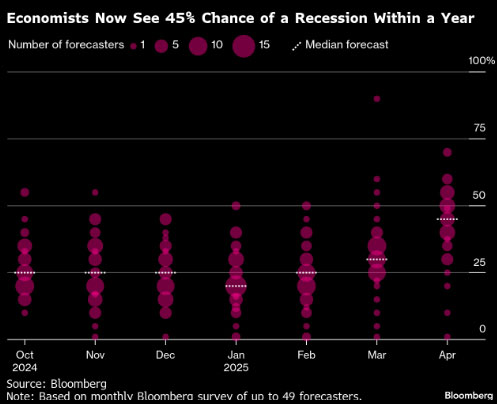

The U.S. economy is expected to grow 1.4% in 2025 and 1.5% in 2026, according to the latest survey of economists, compared with 2% and 1.9%, respectively, in last month’s survey. The median forecast of economists surveyed now puts the probability of a recession in the next 12 months at 45%, up from 30% in March.

Trump’s decision to impose tariffs of at least 10% on most countries has many forecasters warning of a sharp slowdown, with some even predicting a recession this year. That’s partly because of a sharp downgrade in household demand, which accounts for about two-thirds of gross domestic product.

“Stronger economic growth requires a faster resolution to the trade war and renewed confidence in U.S. policymaking,” said Brett Ryan, senior U.S. economist at Deutsche Bank.

Although the Trump administration has imposed a 90-day pause on some of the higher tariffs announced earlier this month, the current effective U.S. tariff rate has risen to nearly 23% - the highest level in more than a century, according to data from Economic Research. This has hit consumer and business confidence.

The International Monetary Fund this week slashed its global growth forecasts and warned that if U.S. tariffs remain in place, they will have a ripple effect on the global economy.

Economists surveyed by Bloomberg now expect imports to grow at an annualized rate of 19.2% in the first quarter of this year as companies rush to ship goods to the United States ahead of tariff increases. They also lowered their growth expectations through 2027.

Forecasters also lowered their expectations for U.S. exports through 2026. Several countries have imposed retaliatory tariffs on U.S. goods, which will make it more expensive to import those products and could lead to a drop in overseas demand.

The Bureau of Economic Analysis is due to release its first-quarter GDP estimate on April 30.

Economists expect the Fed’s preferred inflation measure — the personal consumption expenditures price index (PCE) — to peak at 3.2% by the end of 2025, up from an estimate of 2.7% in the March survey. Core PCE inflation, which excludes food and energy, is expected to reach 3.3%.

“Inflation is expected to rise, but not as much as it did in 2022,” said Bill Adams and Waran Bhahirethan, economists at Comerica Bank. “Since the tariff increase, the Fed has warned that the bar for rate cuts is higher in the face of rising inflation than during a traditional economic shock, which reduces both demand and prices.”

The labor market is expected to remain stable in the short term, with economists expecting an average of 72,000 new jobs per month this year and 100,000 next year. They expect the unemployment rate to rise to 4.6% by the end of 2025, up from the 4.3% projected in March.

The survey was conducted from April 18 to 23 and collected responses from 82 economists.

%20--%3e%3c!DOCTYPE%20svg%20PUBLIC%20'-//W3C//DTD%20SVG%201.1//EN'%20'http://www.w3.org/Graphics/SVG/1.1/DTD/svg11.dtd'%3e%3csvg%20version='1.1'%20id='图层_1'%20xmlns='http://www.w3.org/2000/svg'%20xmlns:xlink='http://www.w3.org/1999/xlink'%20x='0px'%20y='0px'%20width='256px'%20height='256px'%20viewBox='0%200%20256%20256'%20enable-background='new%200%200%20256%20256'%20xml:space='preserve'%3e%3cpath%20fill='%23FFFFFF'%20d='M194.597,24.009h35.292l-77.094,88.082l90.697,119.881h-71.021l-55.607-72.668L53.229,232.01H17.92%20l82.469-94.227L13.349,24.009h72.813l50.286,66.45l58.148-66.469V24.009z%20M182.217,210.889h19.566L75.538,44.014H54.583%20L182.217,210.889z'/%3e%3c/svg%3e)